Ever since self-certified mortgages were banned at the start of the credit crunch, contractors have been trying to obtain a straightforward route to mortgage funding and we ask the question “Can contractors get mortgages?”

Most lenders fail to recognise that contractors can prove less of a risk than permanent workers. This is because many contractors have higher income and possess a wider, more marketable skill set that can help them continually secure work and keep up their mortgage repayments without problems when their current contract comes to an end.

There are a number of things to consider when getting a mortgage as a contractor

When approaching a bank, you have to neatly fit into one of its categories. There’s “Employed” or “Self-Employed”. A limited company director is self-employed, and the umbrella company would be employed. Anyone using one of many creative offshore mechanisms is at the mercy of the bank as to which category they fall into. So, what’s the problem if you know this will be the approach from banks? Surely you just prepare your payslips or trading accounts accordingly right?

However, there are sub-categories, and more detailed criteria, and assumptions regarding taxable income, and that’s the tip of a complicated iceberg with one lender.

Different lenders have different views on risk. Unless you are a permanent employee, or self-employed under your own name with a long track record and history of paying maximum tax, lenders can usually find a reason to say “No”. The “No” usually presents itself as a request for further information. Examples would be, “Please supply your last two P60s”, or “Please supply the last 3 years SA302s”. This begs a few questions.

You can view some of our lenders here: CMME Contractor Mortgage Lenders

Those contractors who are lucky enough to successfully get a mortgage approved after approaching a lender direct will often find that they cannot borrow based on their full contract earnings, due again to the conventional income verification procedures used.

Worse still, those contractors who have been declined after approaching a lender direct may find it even more difficult to go on to secure mortgage borrowing elsewhere.

A firm that knows the contractor mortgage landscape can help. The right firm will avoid the need for providing irrelevant HMRC documents by presenting the case in the correct manner – as a professional contractor who is eligible for bespoke underwriting for mortgages rather than a limited company director or employee.

Getting the banks to understand the risk profile of a contractor is not something you can go into a bank and demand. Heightened understanding and more relevant risk assessment for contractors comes via ongoing negotiation and presentation of large volumes of mortgage applications from contractors over a sustained period of time. Developments in tax legislation and the resulting complexity of certain umbrella mechanisms means this dialogue has to continue. That’s where the contractor mortgage broker comes in.

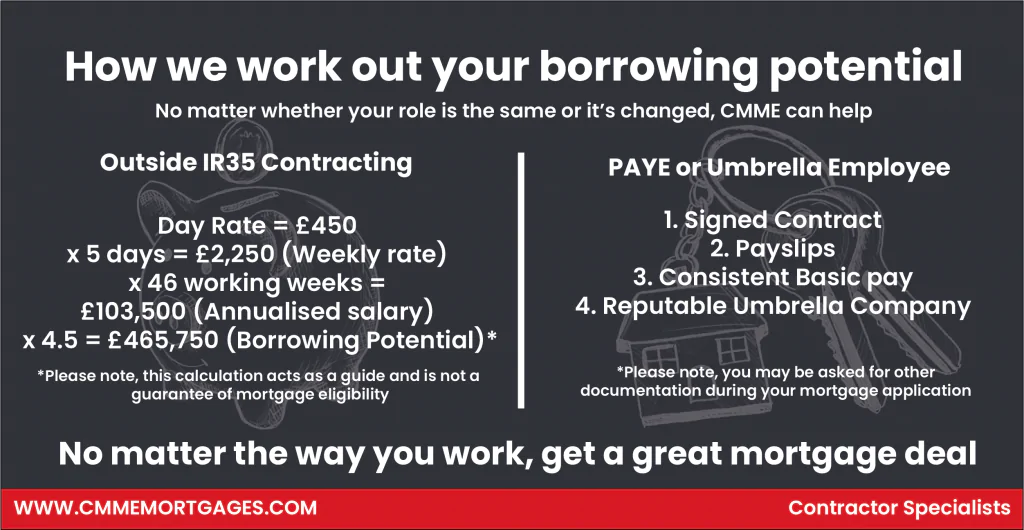

Using our Mortgage Day Rate Calculator is a great way to find out how much you could borrow

When presented by a specialist broker, banks understand the typical contractor client scenario in a different manner. They understand the niche skills of the potential borrower that allow a steady flow of contract income, with minimal enforced periods out of work. They understand the caliber of the end client requiring the services of such a person. They understand that historic lending arranged by a contractor mortgage broker has a very low default rate. They know verification of affordability has been carried out diligently. The banks like working with this type of broker as a result of all of these points, and it means the contractor stands to benefit from this familiarity.

When looking at contractor mortgages it is also important to note that not all lenders offer specific contractor mortgages and many still take the conventional route in assessing your income.

So, coming back to the question at the top “can contractors get mortgages?”, the answer is most definitely “yes” with a little bit of help.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |